south dakota property taxes by county

Minnehaha County-2062 and Pennington County-1995. By the assessed market value of your property.

Tax Information In Tea South Dakota City Of Tea

Tax amount varies by county.

. Of course these counties have the highest number of residents but how are property taxes calculated in South Dakota. Please notate ID wishing to pay. Dakota County All Rights Reserved Disclaimer.

To protect your privacy this site uses a security certificate for secure and confidential communications. See Property Records Deeds Owner Info Much More. The median property tax in Codington County South Dakota is 1461 per year for a home worth the median value of 131000.

Homeowners have until March 15 to apply for property tax relief through the owner-occupied program. To 5 pm Monday - Friday. Codington County collects on average 112 of a propertys assessed fair market value as property tax.

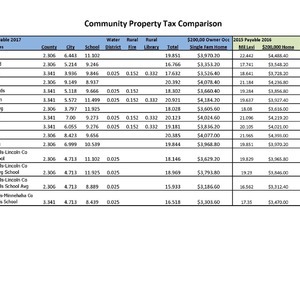

In South Dakota the maximum county tax levy is 12 mills or 12 per thousand dollars of assessed value. Lincoln County has entered an agreement with GovTech Service Inc for online property tax payments. Then the property is equalized to 85 for property tax purposes.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. Inheritance and Estate Taxes.

SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to. Real Estate taxes are paid one year in arrears. Ad Look Up Any Address in South Dakota for a Records Report.

South Dakota is ranked 825th of the 3143 counties in the United States in order of the median amount of property taxes collected. The voters of South Dakota repealed the state inheritance tax effective July. The Department of Revenue has all the answers here.

Learn About Owners Year Built More. If your taxes are delinquent you will not be able to pay online. Special assessments are due by April 30 th also.

To view all county data on one page see South Dakota property tax by county. In South Dakota the county treasurer is responsible for issuing motor vehicle. For an additional convenience fee listed below you may pay by ACH or credit card.

In South Dakota the county treasurer is responsible for issuing motor vehicle titles licenses and registrations on about 1 million. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

So at that rate our 10000 piece of property would cost us 120 in taxes. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of. Find Details on South Dakota Properties Fast.

First half property taxes are due by April 30 th. 33 rows South Dakota Property Taxes by County. Taxes that accrue in 2019 are due and payable in 2020 Tax notices are mailed by mid-February.

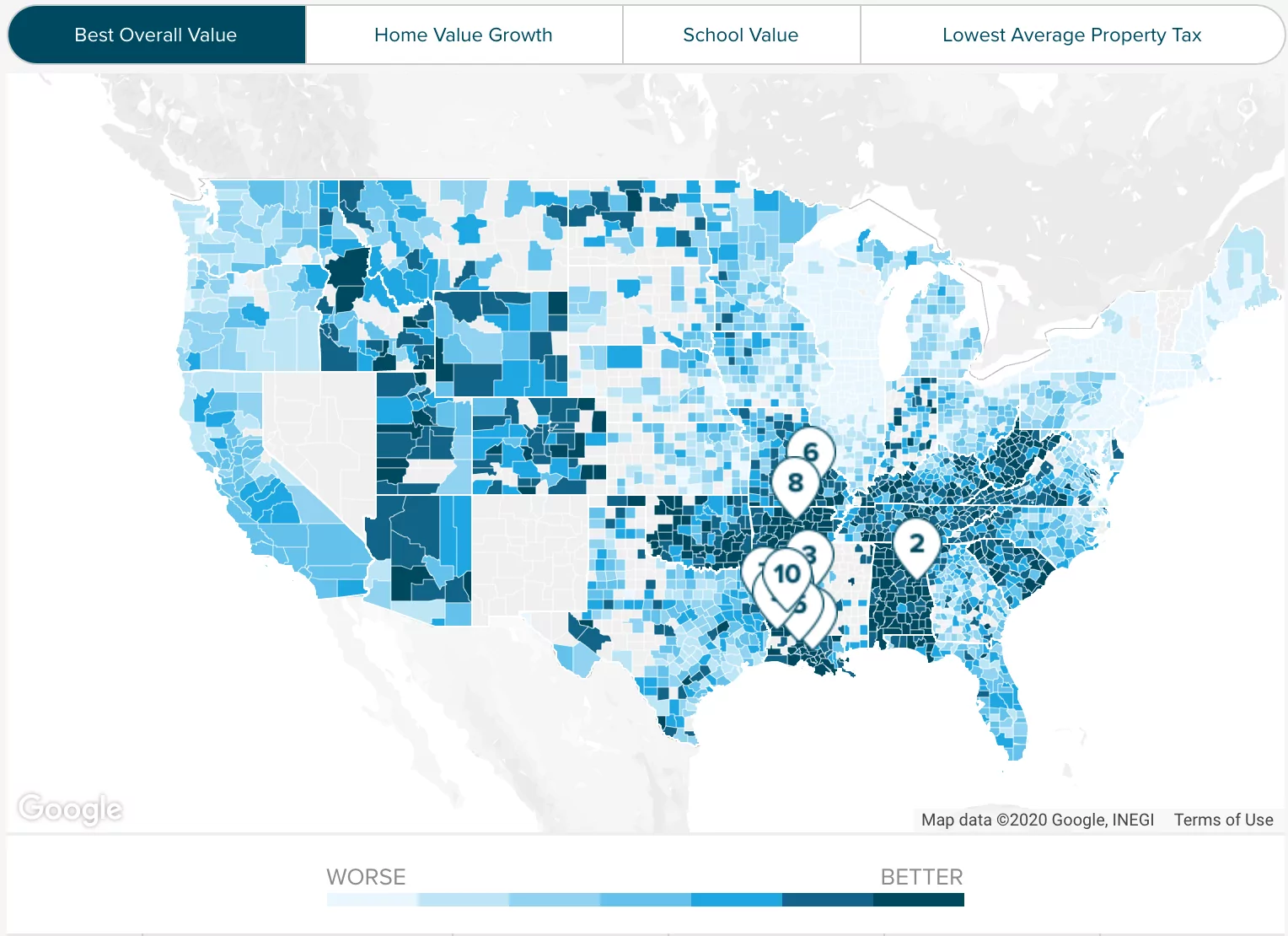

For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. South Dakota Enter your financial details to calculate your taxes Average County Tax Rate 1330 Union County Property Taxes 3325 Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000 Todays Best 30 Year Fixed Mortgage Rates Based on a 200000 mortgage 30 yr Fixed 15 yr Fixed 51 ARM Source. South Dakota does not have an inheritance tax.

Any South Dakotan who owned and occupied a home on November 1 2021 is eligible for this classification and its property tax reduction. Convenience fees 235 and will appear on your credit card statement as a separate charge. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Redemption from Tax Sales. See Results in Minutes. See Property Records Tax Titles Owner Info More.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Search Any Address 2. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred.

A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. The treasurer as the tax collector is responsible for collecting all property taxes for the county cities school districts and any other political district authorized to levy real estate taxes. Second half are due by October 31 st.

Of that 14 billion or 203 of the total revenue collected comes from property taxes. The money from the taxation of these vehicles is collected and remitted to the state of South Dakota. Get In-Depth Property Reports Info You May Not Find On Other Sites.

This site is designed to provide you with additional methods to research your property information and to allow you to pay your property taxes online. If you own property in Lincoln County then you pay the highest amount at 2470. But South Dakota also allows additional levies for roads snow removal and buildings as well as other taxing entities.

The county treasurer also collects property taxes for the county city school districts and any other political district authorized to levy real estate taxes. Please call the Treasurers Office at 605 367-4211. Search Any Address 2.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. In addition all taxes under 50 are due and payable in.

Tax Information In Tea South Dakota City Of Tea

Property Taxes By State County Lowest Property Taxes In The Us Mapped

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Historical South Dakota Tax Policy Information Ballotpedia

Property Tax Comparison By State For Cross State Businesses

Property Tax Definition Learn About Property Taxes Taxedu

Property Tax South Dakota Department Of Revenue

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax South Dakota Department Of Revenue

Property Taxes Calculating State Differences How To Pay

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Dakota County Mn Property Tax Calculator Smartasset

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset